By: John S. Morlu II, CPA

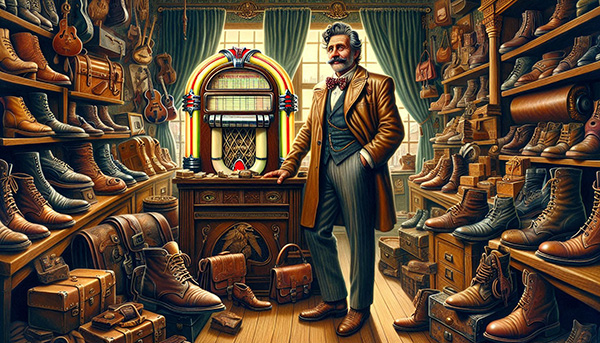

In the picturesque town of Prosperityville, where golden cornfields stretch endlessly under the sun and antique shops line the cobblestone streets, lived a man whose aspirations were as grand as they were misguided. Terrence McGillicuddy, the owner of “The McGillicuddy Leather Emporium,” ran a quaint establishment that specialized in refurbishing vintage leather boots and handbags. On the surface, Terrence’s shop seemed like a quaint corner of Americana, but behind its charming facade lay a financial saga that would soon captivate the town—and not in the way he had imagined.

Terrence was a man of big dreams and even bigger blunders. His approach to business was less about numbers and more about fantasy, turning The McGillicuddy Leather Emporium into a case study in financial delusion. While the town saw a humble leather shop, Terrence saw a goldmine waiting to be tapped—at least, in theory. His financial practices, a haphazard blend of wishful thinking and tax avoidance, created a narrative that could have been plucked from the pages of a satirical novel. As Terrence aimed for the stars with a fantastical valuation of his business, he unwittingly set the stage for a drama that would unfold with all the comedic timing of a well-crafted farce.

What began as an ordinary business venture soon spiraled into a legendary tale of inflated dreams and financial folly. Terrence’s journey from local entrepreneur to the town’s most talked-about character was marked by his insistence on valuing his shop not by market standards, but by the whims of his imagination. His story became a cautionary and comedic example of how lofty dreams, when divorced from reality, can lead to spectacular and often humorous failures. In the end, Prosperityville’s own financial fable would serve as a powerful reminder of the importance of grounding business aspirations in real-world practices—an engaging lesson wrapped in a tale of overblown ambitions and undeniable charm.

Terrence’s Grand Vision

Terrence McGillicuddy was not your run-of-the-mill entrepreneur. His business was more than a modest repair shop; it was, in his eyes, a veritable goldmine. Terrence had a unique approach to financial management that could only be described as artistic. His bookkeeping methods were a whimsical tapestry of creative expense reporting and inflated profits. He had turned managing his business’s finances into an elaborate performance art, balancing the books with the same flair that he brought to his vintage ads.

In his quest for financial creativity, Terrence used his business as a personal piggy bank. The Emporium’s modest income financed his lavish golf outings, extravagant dinners, and even a collection of antique jukeboxes. The balance sheets, when scrutinized, seemed less like records and more like a fantasy novel—a tale where profits were exaggerated to heroic proportions and expenses magically aligned with his lifestyle. Terrence’s approach to avoiding taxes and maximizing deductions could only be described as imaginative, making Picasso’s abstract art seem straightforward by comparison.

The Million-Dollar Dream

After years of running his business with an eye more on minimizing taxes than maximizing profitability, Terrence decided it was time for a grand exit. His plan? To sell The McGillicuddy Leather Emporium for a princely sum of $8 million. This figure was not derived from any realistic appraisal or market research but was instead the product of a grand vision fueled by enthusiasm and optimism. To Terrence, the Emporium’s value was intrinsically linked to his personal charisma and its “potential,” not its actual financial performance.

“Why $8 million?” one might ask. According to Terrence, it was a simple matter of multiplying his dreams by the square root of ambition and then sprinkling in a dash of wishful thinking. In his mind, the Emporium wasn’t worth a mere $1 million; it was worth $8 million because that’s how much he felt it should be worth. The shop had survived fashion trends, economic downturns, and the occasional coffee spill from a visiting folk singer. Clearly, this was a business with the potential for grandeur.

Enlisting the Expert: Cynthia Hawkins

Enter Cynthia Hawkins, a CPA with a reputation for honesty and a talent for navigating financial chaos. Terrence, brimming with confidence and excitement, engaged Cynthia to facilitate the sale. Cynthia, intrigued by the challenge, began her due diligence with the enthusiasm of a detective on a high-profile case.

Her first encounter with Terrence’s financial records was akin to opening a mystery novel. The balance sheets read like a work of fiction, where profits were portrayed as heroic and losses as tragic. Terrence’s accounting was so imaginative that it made even the most creative accountants look like amateurs. Expenses were cleverly disguised, profits were wildly exaggerated, and the overall picture was a masterpiece of financial fantasy.

“Terrence,” Cynthia began diplomatically, “your financials are… unconventional. To ensure a fair valuation, we should conduct a professional appraisal.”

Terrence, however, was unimpressed. “A professional appraisal? Cynthia, my friend, I’ve got a better idea. We’ll use a multiplier based on how I feel about the business and how much I’ve invested in dreams. $8 million is more than fair. Think of it as a negotiating point!”

The Due Diligence Farce

With the sale price set at $8 million, Cynthia’s expert advice was effectively sidelined. A potential buyer, attracted by the glossy brochures and Terrence’s infectious enthusiasm, agreed to move forward. The due diligence process quickly became a spectacle. The buyer’s team, trained to decipher financial knots, encountered a labyrinth of inflated profits and misreported expenses.

The process was nothing short of theatrical. The buyer’s experts, like characters in a financial drama, attempted to reconcile the discrepancies with the seriousness of a mission to save the world. Terrence’s financial records were so disjointed that they could have been the subject of a new reality TV show: “When Good Businesses Go Bad.”

“Terrence,” said the buyer’s chief financial officer, a man who had seen many financial follies, “your business’s financials are not just optimistic; they are otherworldly. Your reported profits are akin to claiming that your business is the next Apple when in reality, it’s more of a boutique kiosk.”

Despite their best efforts to resolve the differences, the discrepancies proved insurmountable. Terrence’s $8 million dream valuation collapsed faster than a house of cards, and the deal fell apart.

The Blame Game Begins

In the aftermath, Terrence’s frustration knew no bounds. Blame, like confetti at a parade, was thrown in every direction, but most of it was directed at Cynthia Hawkins. To Terrence, Cynthia was the villain in his tragic play—someone who had failed to grasp the grandeur of his vision.

“If only Cynthia had backed my valuation!” Terrence lamented to anyone who would listen. “She was supposed to be the expert, yet she didn’t see the potential in my $8 million asking price!”

Cynthia, ever the professional, responded with calm and clarity. “Terrence, my role was to ensure that your business’s valuation was grounded in reality. The figures you presented were not just ambitious; they were fundamentally flawed. A business’s worth is determined by its financial performance and market conditions, not by how much you want it to be worth.”

Despite Cynthia’s rational explanation, Terrence’s grievance grew into a local legend. Prosperityville, with its love for storytelling, now had a new favorite tale—a story of dreams dashed and expectations unmet, all due to a misalignment between reality and fantasy.

The Lesson in Humor and Reality

The story of Terrence McGillicuddy serves as both a humorous cautionary tale and a valuable lesson in business valuation. It highlights the pitfalls of treating a business as a personal checking account and the dangers of inflating its value based on personal aspirations rather than professional advice.

In reality, small business owners need to understand that business valuations are grounded in financial metrics, market conditions, and industry standards. Inflating the value based on personal dreams or sentimental attachments can lead to costly consequences. Just as Terrence’s $8 million asking price was grounded in his own version of reality, so too should business valuations be rooted in tangible data and expert analysis.

The tale of Terrence McGillicuddy is a reminder that in the world of business, reality is the ultimate arbiter of value. It’s not enough to wish, dream, or imagine a higher valuation; one must substantiate it with solid financials and market data. The $8 million asking price was never going to materialize, just as a magic wand won’t turn a pumpkin into a carriage.

As for Cynthia Hawkins, she remains a paragon of financial integrity, her tale of dealing with Terrence McGillicuddy becoming a legend in its own right. And Terrence? He’s left to reflect on his misadventures, perhaps learning that while dreams are important, grounding them in reality is crucial for true success.

Thus ends the satirical saga of Terrence McGillicuddy—a man whose grand dreams of wealth were ultimately grounded by the immutable laws of business valuation. As Prosperityville continues to flourish, it does so with a new story to tell, blending humor with a valuable lesson about the importance of realistic financial planning and professional guidance.

Author: John S. Morlu II, CPA is the CEO and Chief Strategist of JS Morlu, leads a globally recognized public accounting and management consultancy firm. Under his visionary leadership, JS Morlu has become a pioneer in developing cutting-edge technologies across B2B, B2C, P2P, and B2G verticals. The firm’s groundbreaking innovations include AI-powered reconciliation software (ReckSoft.com) and advanced cloud accounting solutions (FinovatePro.com), setting new industry standards for efficiency, accuracy, and technological excellence.

JS Morlu LLC is a top-tier accounting firm based in Woodbridge, Virginia, with a team of highly experienced and qualified CPAs and business advisors. We are dedicated to providing comprehensive accounting, tax, and business advisory services to clients throughout the Washington, D.C. Metro Area and the surrounding regions. With over a decade of experience, we have cultivated a deep understanding of our clients’ needs and aspirations. We recognize that our clients seek more than just value-added accounting services; they seek a trusted partner who can guide them towards achieving their business goals and personal financial well-being.

Talk to us || What our clients says about us