By: John S. Morlu II, CPA

In the frenetic arena of modern entrepreneurship, where billion-dollar valuations and venture capital investments steal the spotlight, there lurks a charmingly absurd subgenre: the hobby business. This is not your typical startup with grandiose visions and investor pitch decks but rather a whimsical endeavor where individuals transform their personal passions into “businesses” with the same seriousness as a kid setting up a lemonade stand. These ventures, often fueled by enthusiasm more than financial acumen, resemble amateur garage bands that dream of stardom but struggle to fill a local coffee shop. The contrast between ambition and reality is stark, making these hobby businesses both endearing and comical.

The true spectacle unfolds when these well-intentioned hobbyists find themselves under the scrutiny of the IRS, armed with its formidable magnifying glass and an unwavering commitment to uncovering financial truths. The IRS’s involvement introduces a fascinating dynamic, where the seemingly innocuous and passionate projects are examined with the rigor of a high-stakes audit. The result is a clash of delusions and realities, as what was once a playful pursuit now faces the stern glare of tax regulations and fiscal accountability.

In this satirical journey, we delve into the hilarity of what happens when the IRS confronts these charmingly misguided hobby businesses. It’s a tale where the line between genuine entrepreneurial spirit and delightful delusion is hilariously blurred. Prepare to be amused as we explore the quirks and missteps of these ventures, where a genuine love for bonsais or craft beer collides with the cold, hard logic of tax laws. Welcome to a world where passion meets paperwork, and where every enthusiastic claim is met with a dose of financial reality.

The Business of Hobbies: An Introduction

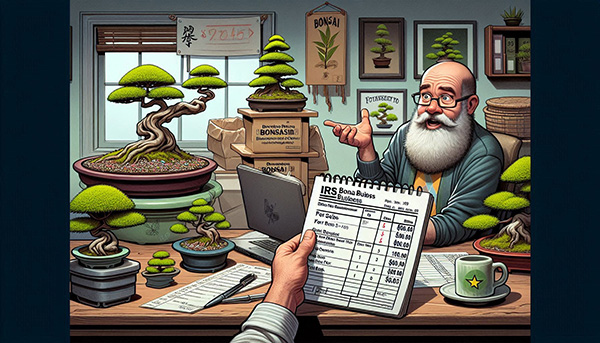

Imagine stepping into Bob’s garage, which has been transformed into a whimsical haven for bonsai trees, aptly named Bob’s Bizarre Bonsai Emporium. Here, Bob, an ardent bonsai aficionado, immerses himself in nurturing these miniature marvels with an enthusiasm that rivals the most dedicated of horticulturists. His days are spent meticulously pruning, watering, and whispering encouragements to his beloved bonsais, while his nights are consumed by dreams of grandeur—dreams that include an Instagram account dedicated to his craft and the occasional sale of a tree to his neighbors. His most frequent and perhaps only customer is Aunt Gertrude, who, driven more by family duty than genuine interest, purchases a bonsai each year to support Bob’s lofty aspirations.

Bob’s setup is emblematic of what we affectionately call a hobby business—a venture driven more by personal passion than by concrete business principles. From the outside, Bob’s Bonsai Emporium exudes a certain charm; it’s the epitome of enthusiasm where every bonsai is a labor of love rather than a lucrative asset. However, despite its endearing qualities and Bob’s unwavering dedication, his “business” represents a classic example of the hobby business phenomenon. It’s an endeavor where the joy of the pursuit often overshadows the practicalities of running a profit-oriented enterprise.

The stark reality, though, is that the IRS sees things differently. To the tax authorities, a genuine business isn’t just a passion project with whimsical aspirations; it’s a structured entity designed with the ultimate goal of generating profit. The IRS’s criteria are rooted in tangible measures of financial viability, not in the warmth of familial support or the charm of a well-tended bonsai. Thus, while Bob’s Bonsai Emporium might be a heartwarming example of personal devotion, it stands as a quintessential case study in the contrast between genuine entrepreneurial endeavors and the charming delusions of hobbyists.

The IRS Audit: Entering the Hobby Business Realm

Enter Dave, the IRS auditor, a figure of authority who carries the weight of tax regulations with an air of indomitable precision. Dave is not just any auditor; he’s a seasoned professional with a keen eye for detecting the discrepancies and eccentricities that can arise when personal passions masquerade as legitimate businesses. Armed with a briefcase brimming with forms, schedules, and a steely resolve, Dave’s mission is as clear as it is daunting: to wade through the sea of receipts, tax returns, and spreadsheets to discern whether Bob’s Bonsai Emporium is genuinely a business or merely a glorified hobby.

Upon arriving at Bob’s quaint, unassuming home, Dave is met with a sight that is as perplexing as it is intriguing. Bob, with all the enthusiasm of a proud parent, welcomes Dave into his bonsai sanctuary. The scene is set for an encounter where expectations clash hilariously with reality. Dave’s entrance is marked by a pronounced sense of skepticism—an essential tool in his professional arsenal.

Dave: “Good morning, Bob. I’m here to review your tax returns and verify that your bonsai business is operating as an actual business. Shall we begin?”

Bob: “Of course, Dave. I’m thrilled to show you around. My bonsais are exceptional!”

As Dave starts his inspection, the peculiarities of Bob’s “business” quickly become apparent. The garage, which Bob proudly calls his office, is adorned with an array of bonsai-themed paraphernalia. Among the items scattered about are bonsai mugs emblazoned with motivational quotes, miniature gardening tools that seem more suited for a dollhouse than a business, and an elaborate watering system that appears to be designed for interstellar travel rather than horticulture. Dave’s eyes widen as he takes in the sight of Bob’s “office”—a cluttered desk overwhelmed with hand-drawn graphs and charts that compare the number of bonsais sold with the number given away to friends and family.

The graphs, executed with the precision of a kindergarten art project, are an earnest yet comically inadequate attempt to present financial data. They display an ambitious array of figures that highlight the disparity between actual sales and the bonsais generously gifted to acquaintances. Dave can’t help but notice the contrast between Bob’s grandiose plans and the humble reality of his operations. The juxtaposition is as amusing as it is revealing, setting the stage for a comical exploration of how Bob’s bonsai hobby is being scrutinized under the lens of IRS regulations.

The Defining Moments of the Audit

1. The Revenue Reality Check

Dave’s audit begins with an examination of Bob’s revenue claims. Bob proudly presents his records, which show a grand total of six bonsai sales over the past year, each priced at a modest $30. This translates to a projected annual revenue of $180—a figure that, while optimistic, seems to exist more in the realm of hopeful fantasy than financial reality. Dave’s eyebrow raises as he reviews these figures, his curiosity piqued by the stark contrast between Bob’s lofty ambitions and the meager financial returns.

Dave: “Bob, can you explain how you arrived at the revenue figures in your business plan?”

Bob: “Well, Dave, I’m planning to expand my customer base. I’ve just started posting bonsai care tips on my blog, and I’m certain that sales will skyrocket.”

Dave: “That’s an interesting approach. However, have you considered how the current revenue aligns with your expense claims?”

Bob: “Of course! I’ve invested heavily in bonsai soil, which is very rare. It’s an investment in the future.”

Dave’s skepticism deepens as he considers Bob’s grandiose plans juxtaposed with the current revenue figures. The optimism in Bob’s voice contrasts sharply with the stark numbers, painting a picture of a venture that is more hopeful dream than robust business. The dissonance between projected growth and actual earnings sets the tone for a deeper dive into Bob’s financial landscape.

2. The Expense Exposé

The next stage of Dave’s audit takes him to the realm of Bob’s expense claims, where things become even more intriguing. Bob has listed a variety of deductions that seem to stretch the limits of conventional business expenses. Among these are claims for an elaborate bonsai-themed garden gnome collection, several pieces of bonsai-inspired art, and a monthly subscription to “Tree Lovers’ Digest.” Dave’s initial bemusement turns into a full-fledged investigation as he examines these unusual items.

Dave: “Bob, I see you’ve listed several expenses that seem rather… unconventional. How do these relate to your business operations?”

Bob: “Oh, the garden gnomes are for decoration! It creates an ambiance for the bonsais. And the art? It’s motivational!”

Dave: “Motivational art? Is that a common expense for businesses in this industry?”

Bob: “It’s a personal touch!”

Dave’s sense of bewilderment grows as he listens to Bob’s explanations. The “decorative” garden gnomes and “motivational” art pieces seem more suited for a personal hobby than a business expense. Bob’s creative justifications for these expenditures highlight the clash between his passionate pursuit and the practical requirements of running a legitimate business. The absurdity of the situation underscores the broader issue at hand: the struggle to balance genuine enthusiasm with the hard truths of financial accountability.

3. The Profit Motive

As Dave delves deeper into the intricacies of Bob’s bonsai venture, the focus shifts to one of the fundamental tenets of any legitimate business: the profit motive. In the world of genuine enterprises, the ability to generate profit is crucial, and the absence of it raises significant red flags. Bob’s records show that he has yet to make a profit over the past two years, a glaring indicator of potential issues. When confronted with this concern, Bob’s response is as optimistic as it is vague.

Dave: “Bob, I notice you haven’t made a profit in over two years. Is there a plan in place to change this?”

Bob: “Oh, absolutely! I’m working on a new bonsai that will be a breakthrough. I’m calling it the ‘Bob’s Big Bonsai.’ It’s going to be huge!”

Dave: “When is this breakthrough expected?”

Bob: “Well, I’m still working on it. It’s a work in progress.”

Bob’s enthusiasm for his “Big Bonsai” is palpable, but his response lacks the concrete details necessary to convince Dave of a viable business plan. The vague timeline and undefined breakthrough reflect a pattern of dreaming big without actionable steps. For Dave, this is a classic sign of a hobbyist’s hopeful aspirations rather than the strategic planning of a successful entrepreneur. Bob’s ongoing struggle to turn his passion into profit underscores the challenges he faces in transitioning from a delightful hobby to a credible business venture.

4. The ‘Deductible’ Dilemma

The final aspect of Dave’s audit brings him face-to-face with Bob’s unconventional approach to deductions. Among the more unusual claims Bob has made is a deduction for his annual bonsai-themed costume party, which includes expenses for a bonsai tree costume and various bonsai-themed games. Dave’s bemusement grows as he examines these claims, but his professionalism remains steadfast.

Dave: “Bob, I see you’ve claimed deductions for a costume party and related expenses. How do these contribute to your business?”

Bob: “It’s all about brand building and networking! I’m creating a bonsai community.”

Dave: “A bonsai community… through costume parties?”

Bob: “Absolutely! People remember the bonsai costumes!”

Bob’s justification for the deductions adds a layer of whimsy to the audit. His belief that costume parties can foster brand recognition and community engagement reflects the passionate but misaligned nature of his business operations. While the idea of creating a bonsai community through playful events is endearing, it does little to substantiate the business legitimacy required by tax regulations. Dave’s continued questioning reveals the disconnect between Bob’s enthusiastic personal pursuits and the practicalities of running a bona fide business.

The Verdict: Hobby or Business?

After a thorough examination of Bob’s financial records, expense claims, and overall business operations, Dave arrives at his conclusion. Despite the charm and dedication Bob exhibits toward his bonsai venture, it is clear that his enterprise falls squarely within the realm of a hobby rather than a true business. The persistent lack of profit, questionable expense claims, and the overall setup of Bob’s operations suggest that his endeavor is more about personal enjoyment than entrepreneurial success.

Dave: “Bob, it’s clear that you have a deep passion for bonsais, and your dedication is commendable. However, based on the evidence, it appears that your bonsai venture is more of a hobby than a business. For tax purposes, this means some of your deductions might not be valid.”

Bob: “Oh, I understand. I suppose I got a little carried away.”

Dave: “It’s all part of the journey. Keep nurturing those bonsais. Who knows? With the right strategy, your hobby might just bloom into a thriving business someday.”

Dave’s final words reflect a balance of professionalism and encouragement, acknowledging Bob’s passion while gently steering him toward a more realistic understanding of what constitutes a business. The audit concludes with a mix of humor and practical advice, leaving Bob with valuable insights into the complexities of turning a beloved hobby into a legitimate enterprise.

The Aftermath: Lessons Learned

Bob’s whimsical encounter with the IRS serves as a comedic yet profound lesson on the nuanced distinction between a hobby and a business. Through the lens of Bob’s bonsai venture, we see that while passion and enthusiasm are essential for any entrepreneurial endeavor, they must be coupled with a robust business strategy, realistic financial projections, and a clear profit motive to truly transform a hobby into a legitimate enterprise. Bob’s experience underscores the importance of aligning one’s passion with the practicalities of business operations, where genuine financial planning and adherence to tax regulations play pivotal roles.

In the aftermath of the audit, Bob’s bonsai business stands as a testament to his personal passion and creativity but also as a humorous reminder that not every hobby qualifies as a tax-deductible enterprise. The comedic nature of Bob’s expense claims and revenue projections highlights the common pitfalls that many aspiring entrepreneurs face when their ventures are more about personal joy than business viability. This encounter serves as an important reminder for those embarking on their own business journeys: the IRS’s scrutiny, while daunting, presents an opportunity to refine operations and ensure that your enterprise meets the rigorous standards of a legitimate business.

As you pursue your passions—whether it’s selling bonsais, crafting elaborate costumes, or exploring any other niche—be prepared for the realities of running a business. Make sure your enterprise aligns with the IRS’s expectations and is backed by a well-thought-out plan. And if you find yourself facing an audit, approach it with the understanding that it’s not just a challenge but a chance to strengthen your business framework. After all, a good-natured audit might just be the catalyst that helps your hobby blossom into a thriving and tax-compliant business.

Author: John S. Morlu II, CPA is the CEO and Chief Strategist of JS Morlu, leads a globally recognized public accounting and management consultancy firm. Under his visionary leadership, JS Morlu has become a pioneer in developing cutting-edge technologies across B2B, B2C, P2P, and B2G verticals. The firm’s groundbreaking innovations include AI-powered reconciliation software (ReckSoft.com) and advanced cloud accounting solutions (FinovatePro.com), setting new industry standards for efficiency, accuracy, and technological excellence.

JS Morlu LLC is a top-tier accounting firm based in Woodbridge, Virginia, with a team of highly experienced and qualified CPAs and business advisors. We are dedicated to providing comprehensive accounting, tax, and business advisory services to clients throughout the Washington, D.C. Metro Area and the surrounding regions. With over a decade of experience, we have cultivated a deep understanding of our clients’ needs and aspirations. We recognize that our clients seek more than just value-added accounting services; they seek a trusted partner who can guide them towards achieving their business goals and personal financial well-being.

Talk to us || What our clients says about us