Did you know that under federal law, taxpayers are required to pay taxes throughout the year as they earn income? Failing to do so can lead to hefty underpayment penalties. This can be a significant burden, especially if you’ve already spent the money owed in taxes.

To avoid this situation, the government offers several methods to help taxpayers meet their tax obligations on an ongoing basis. Let’s delve into these methods and explore how to ensure you’re not caught off guard come tax season.

Prepaying Your Taxes: Various Methods Available

There are several ways to prepay your taxes, depending on your employment situation and income sources. Here’s a breakdown of the most common methods:

- Payroll Withholding for Employees (W-4): This is the most common method. Your employer withholds income tax from your paycheck based on the information you provide on your W-4 form.

- Pension Withholding for Retirees (W-4P): Similar to payroll withholding, if you receive a pension, taxes can be withheld at the source using a W-4P form.

- Voluntary Withholding for Unemployment and Social Security Benefits (W-4V): You can choose to have income tax withheld from your unemployment or Social Security benefits by submitting a W-4V form.

- Estimated Tax Payments for Self-Employed Individuals (Form 1040-ES): If you’re self-employed or have income not subject to withholding, you need to make estimated tax payments throughout the year using Form 1040-ES.

How to Determine Your Withholding Needs

- The IRS Tax Withholding Estimator: This online tool can help employees with primarily wage income assess if their current withholding matches their projected tax liability. If adjustments are needed, you can submit a revised W-4 form to your employer.

- Consulting a Tax Professional: If your income situation is complex, with multiple jobs, rentals, side gigs, or significant income from other sources, consider consulting a tax professional for a more tailored analysis of your withholding and estimated tax payment needs.

Life Changes and Withholding Adjustments

Several life events can impact your tax situation and require adjustments to your withholding or estimated tax payments. Here are some common triggers:

- Changes in tax law: Stay informed about any changes in tax laws that might affect your filing.

- Lifestyle or financial changes: Marriage, divorce, children, homeownership, retirement, or bankruptcy can all impact your tax obligations.

- Changes in employment: Starting, stopping, or changing jobs can affect your wage income and withholding.

- Income not subject to withholding: Interest, dividends, capital gains, self-employment income, and IRA distributions all require estimated tax payments if not subject to withholding.

- Changes in deductions or credits: Reviewing your deductions and credits, like medical expenses, charitable contributions, or dependent care expenses, can help determine your tax liability.

Nonresident Aliens and Withholding

Nonresident alien taxpayers should follow the special instructions outlined in Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens, to determine their tax withholding requirements.

Making Adjustments and Avoiding Penalties

Once you’ve determined the need to adjust your withholding, complete a new Form W-4 and submit it to your employer. For other income sources, use the appropriate form (W-4P or W-4V) to provide the payor with updated withholding instructions.

Understanding Safe Harbor Rules and Avoiding Underpayment Penalties

There’s good news! Federal law (and most states) have “safe harbor” rules. As long as you comply with these rules, you won’t be penalized for underpayment. Here are the two key federal safe harbor provisions, assuming estimated tax payments are made evenly throughout the year:

- 90% of Current Year’s Tax Liability: If your total tax payments equal or exceed 90% of your current year’s tax liability, you’re generally safe from penalties.

- 100% (or 110%) of Prior Year’s Tax: This is the most commonly used safe harbor. Your total tax payments must equal or exceed 100% of your prior year’s tax liability. However, if your adjusted gross income in the prior year exceeded $150,000 ($75,000 for married filing separately), the threshold jumps to 110% of the prior year’s tax.

There’s also a “de minimis” rule: If the amount of tax owed after withholding and estimated tax payments is less than $1,000, you won’t be penalized for underpayment.

When Safe Harbors Don’t Make Sense and Strategic Planning

While the safe harbor rules offer a clear path to avoid penalties, there can be situations where strict adherence might not be the most financially sound approach. For example, imagine you had a substantial one-time income boost in the prior year, inflating your tax liability by $10,000 compared to your typical tax burden. You know this won’t be the case in the current year. Relying solely on the 100%/110% safe harbor would lead to overpaying your estimated taxes throughout the current year by $10,000. In this scenario, using the 90% of current year’s tax safe harbor method might be more strategic. Here, you’d estimate your current year’s tax liability and make adjustments to withholding or estimated tax payments throughout the year to ensure you reach the 90% threshold by filing time.

Planning for Self-Employment and Estimated Tax Payments

Unlike employees who benefit from automatic payroll withholding, self-employed individuals have a different responsibility. They must estimate their net earnings for the year (or utilize the safe harbor provisions) and make quarterly tax payments based on that estimate. Failing to do so will result in interest and potentially penalty charges.

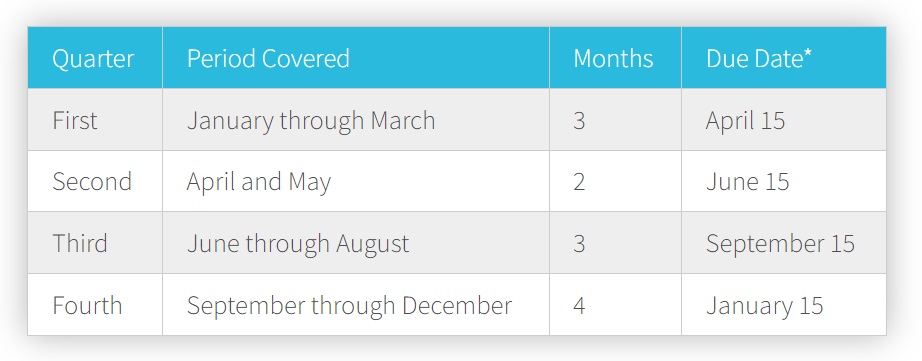

Important Dates to Remember

While the payments are referred to as “quarterly” estimates, the periods they cover don’t strictly follow the calendar quarters. Here’s a breakdown of the estimated tax payment due dates:

*Note: If the due date falls on a weekend or holiday, the payment is due on the next business day.

Conclusion: A Final Thought

It’s important to remember that these rules apply specifically to federal prepayments. Individual states may have their own regulations regarding estimated tax payments.

For a smooth tax season and to avoid underpayment penalties, consider consulting with a tax professional They can guide you through the intricacies of tax law, ensure you’re complying with both federal and state regulations, and help you develop a tax strategy that minimizes your tax burden throughout the year. Don’t hesitate to reach out to us if you have any questions or require assistance in navigating your tax obligations.

JS Morlu LLC is a top-tier accounting firm based in Woodbridge, Virginia, with a team of highly experienced and qualified CPAs and business advisors. We are dedicated to providing comprehensive accounting, tax, and business advisory services to clients throughout the Washington, D.C. Metro Area and the surrounding regions. With over a decade of experience, we have cultivated a deep understanding of our clients’ needs and aspirations. We recognize that our clients seek more than just value-added accounting services; they seek a trusted partner who can guide them towards achieving their business goals and personal financial well-being.

Talk to us || What our clients says about us